Home › Forums › Financial Institutions › Personal Finance Software

- This topic is empty.

-

AuthorPosts

-

June 24, 2024 at 11:27 am #3225

In the past, people managed their finances in many ways. During that period, there was no personal finance software that is commonly seen today.

Some of the ways in which we did this are:

- Manual Ledger and Checkbooks: Some people kept manual ledgers and checkbooks. They used these to manually record their income, spending, and balances.

- Envelope Budgeting System: This was the major system I personally used while growing up. It involved allocating cash into different envelopes labeled for specific spending categories (e.g., groceries, utilities, entertainment, personal development, etc.) So if a particular envelope was empty, spending in that category had to be suspended until the next month.

- Pen and Paper Budgeting: We simply made budgets with pens and paper. Most of us also combined this with the Envelope budgeting method whereby we formed a list of what we needed to spend our money on then allocated the funds into different envelopes for each area Then we tracked income expenses as well as savings goals. However, creating and sticking to budgets really required a high level of self-discipline.

- Financial Advisors and Planners: Those who could afford it consulted financial advisors or planners. These professionals helped with budgeting, investment decisions, and retirement planning.

In those days, manually managing personal finances was often a tedious and error-prone process. Keeping track of income, expenses, budgets, and financial goals across multiple accounts and spreadsheets was time-consuming and often led to overlooked details or missed opportunities.

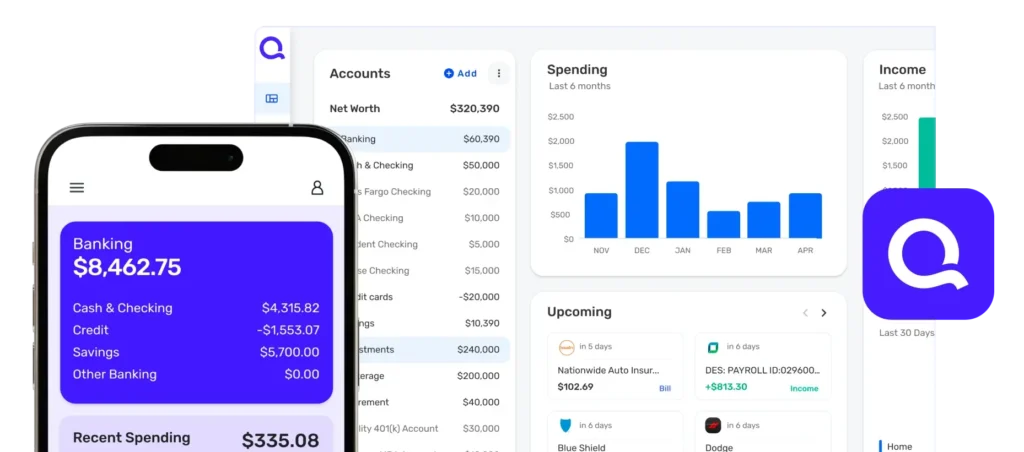

Personal financial software came into the scene and helped to overcome these challenges by offering a single platform for tracking and categorizing transactions, creating and monitoring budgets, and investing too.

By integrating bank accounts and credit cards, these tools remove the need for manual data entry and offer a thorough picture of a person’s financial status.

Whether you’re a seasoned investor or just starting your financial journey, effective money management is important for everyone. And personal finance software makes this process even easier than it has ever been.

What then are personal finance software?

In simple terms, personal finance software refers to digital tools and applications that assist you in budgeting and managing your money, tracking expenses, managing investments or even setting/achieving financial goals all with your device.

One software may differ from another by its feature support, software code and development transparency, mobile app features, monetization model, privacy and data storage practices etc.

Here are the primary categories of personal finance software and what to consider when looking for one.

Personal Finance Software Types

There exist various kinds of personal finance software. This is predominantly because we all have different financial needs and ambitions. For instance, a young professional may opt for saving and budgeting whereas an individual nearing retirement would go for investment management as well as retirement planning.

Furthermore, every form of personal financial management software provides specialized functionalities targeted on particular monetary activities such as budgeting, debt management or tax preparation among others.

Considering that there is no one-size-fits-all approach to financial management these software solutions offer ways to encompass the wide range of financial needs, and preferences of individuals.

Some of the major categories of these software are;

- Budgeting Applications: These tools are invaluable when it comes to your budget. They help you create and track your budget by letting you set up spending limits, categorize/ record your cash flow, give notifications to over expenditure and generally give you the visual presentation of how you typically spend your money. Some of them include Simplifi, YNAB (You Need A Budget), Mint, Mvelopes.

- Financial Planning Software: These applications go beyond simple budgets by helping users plan for their long term financial goals. This software may sometimes include retirement planning functions as well as investment tracking abilities and others that can enable users set their financial targets in life. Examples: Quicken and Empower (formerly Personal Capital).

- Investment Tracking and Management Tools: This category of software is meant for assisting people manage their investment portfolios. They assist with investment tracking (stocks, bonds, mutual funds etc.). Often times they are preferred by investors since as the name suggests itself; among the major features we find portfolio tracking, performance analysis & monitoring, risk assessment tools /calculators , financial news & insights and market research . For example: Quicken Deluxe, Credit Sesame, Personal Capital, SigFig Morningstar

- Savings-Focused Apps: Designed for maximal savings and investing-optimization purposes. They often have features like automated savings facilities or investment trackers or even retirements plans within them.. For instance Greenlight & Rocket Money

- Bill Payment Software: Users of bill payment software are assisted in managing and settling their bills on time. In the presence of these, you will never have to forget to pay bills again due to a plethora of notifications about payments for bills, subscriptions and loans. Quite often they have connections with service providers and enable automatic payments so that you don’t get late fees. An example is Prism, Doxo.

- Tax Software: Preparation solutions for taxes are tools which help individuals prepare and file tax returns. They help you arrange accounting data, calculate deductions and submit your taxes. These tools work well when it comes to demystifying tax filing process as they take you through forms to ensure tax compliance. Examples include TurboTax, as well as H&R Block. These consist step-by-step tax filing guidance, integration with online financial accounts, error checking, audit support and e-filing capabilities.

- Payroll, Payment, and Invoicing Software: While these tools are focused on businesses more than anything else they can also be of value to entrepreneurs or freelancers or self-employed individual. Such things assist in managing revenue streams like incomes expenses payroll etc. Quicken, QuickBooks Online, FreshBooks are known for having such features..

- Multi-purpose Personal Finance Software: The multi-purpose personal finance program combines numerous functions to aid in managing one’s money well. Examples of these are NerdWallet and WalletHub (both have free options). They provide financial advice based on individual situations, credit score monitoring/ tracking as well as budgeting tools.

Every such personal finance software is designed for certain requirements starting from simple budgeting to complex financial planning. As a user you will have to select a combination of these tools to cover different aspects of your financial life.

It would be difficult to advise you on the best software because what may be good for one person may not be suitable for another. The most apt choice for you depends on your particular financial goals and desires. Whether it is saving, investing or debt management, there is probably a personal finance software that suits you.

So, what do you consider when determining the best personal finance software for your unique financial situation?

- Start by identifying your financial needs: You’re not just going to search for a software because of how popular it is. It is your financial needs that make it necessary to get a financial software solution in the first place so you’ll want to start with knowing what is important to you right now.

Whether you are trying to track your income and expenses, or have a specific goal you’re saving towards, trying to grow your wealth via investments or tracking and reducing loans/credit card debt; you must first identify what it is.

Once you have decided on this, you can be confident that the software you choose will meet your unique needs.

- Cost: Some personal finance software are free, while others require a subscription or one-time payment. Determine which one you will be willing to go for. If it’s not free, consider its cost and ensure that it fits within your budget.

Don’t just go for the most expensive option, look for a balance between features and affordability; and evaluate if the features offered justify the cost.

Sometimes free versions provide all the features you need, while at other times, a paid version might offer better value with more advanced features.

According to reputable sources, In 2023, Quicken was considered the best overall personal finance software, but it’s more expensive. If you’re just beginning your personal finance journey and looking for a free alternative, Mint is a great choice.

It provides budgeting assistance and helps track household spending for free. Empower is another affordable option for those interested in tracking their investment accounts.

- Features of the software: After determining which area of your finances you need a software solution for, and how much you’re willing to spend on it, the next most important factor is to consider whether the software actually has what it takes to help you in that area.

For instance, if you’re looking for help with budgeting, the software you ultimately choose must have some vital budgeting tools that can create, track, and adjust budgets.

For expense Tracking, it must have features that can categorize and track expenses.

Financial Goal Setting software must be able to to set and track savings or financial goals.

Capabilities for monitoring investment performance and portfolio management is an important feature to look out for if you’re looking for a software with which to grow your investments.

Your preferred debt management software should have features for tracking debts and planning payments.

And your tax preparation software should have useful tools to assist you with tax calculations and filings.

- Ease of use: Up next, you should consider how easy it is to use the software. It should be fairly easy to set up, with minimal steps required to start managing your finances.

When I started taking my finances seriously, there was a particular software I heard so much about and eagerly wanted to use. However, while trying to set up my account, there were too many complicated steps and words too difficult for a beginner like me to understand.

The whole interface was cluttered and with pop up ads showing at almost every corner. I eventually lost interest in continuing with it after several protocols and went for a less complicated option which has been doing a great job. Since then, I haven’t looked back.

It is important to go for a user-friendly interface. You will be using the program on a frequent basis, thus it should be visually appealing. Check if it offers features like customizable dashboards, easy navigation, and clear categorization of transactions.

Overall, you should put into consideration the time and effort needed to learn and use the software effectively. I always recommend going for a software with an intuitive and user-friendly interface because after all is said and done, you will want a software solution that you actually enjoy using.

- Integration and Compatibility: Integration basically means the process of combining with compatible elements in order to incorporate them. In this context, integration is what allows you to link to bank accounts for credit cards, checking, and savings accounts seamlessly; for automatic transaction imports.

On the other hand, device compatibility enables a given program to be available on different types of computers without modification of the program or the computers

This means that the software you go for should be accessible to you on your preferred devices such as desktop, mobile, or on a website interface. Life is on the move, and managing finances from your phone can be convenient, at anytime necessary.

- Security, Privacy, and Regular updates.

Another important thing to do is to make sure you choose personal finance software which is secured so that you can keep all your documents encrypted and even provide more means of security like two-factor authentication.

Also, it is better off you select a software that frequently receives updates for functional efficiency and safety reasons as well as other ongoing support and maintenance.

Conclusion

Those days when people relied on manual methods of managing finances, such as ledgers, envelope budgeting systems or pen and paper were gone.

These practices were time-consuming and liable to mistakes. Thus, the entire process has been completely revolutionized by personal finance software enabling users to come up with budgets, track expenses, manage investments, set goals—everything right from their devices.

When choosing personal finance software there are a few things to consider since it is not an easy decision. First of all identify what you need most: whether it’s budgeting/investment tracking or any other financial operations.

Then examine the cost, look at features available; take into account how simple or complex the system will be in use, its levels of security and finally weigh compatibility with existing accounts.

It’s also worth mentioning that ultimately, the best choice depends much on one’s own circumstances as well as goals.

Resources

- Checkbook Register Log Book – Amazon

- The Envelope Budgeting System – Investopedia

- How to do a pen and Paper Budget – Reddit

- Difference between a Financial Advisor and a Financial Planner – Frazer James

-

AuthorPosts

- You must be logged in to reply to this topic.